Statement of Retained Earnings: Definition, Formula & Example Video & Lesson Transcript

Content

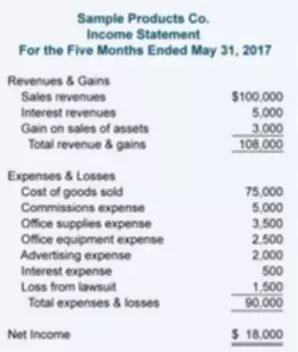

From this data, you can calculate the retention ratio (how much profit is retained by the business) by dividing the retained earnings by the net income. The payout ratio is calculated by dividing the dividends paid by the net income. Finally, you can calculate the amount of retained earnings for the current period.

For instance, if a company pays one share as a dividend for each share held by the investors, the price per share will reduce to half because the number of shares will essentially double. Because the company has not created any real value simply by announcing a stock dividend, the per-share market price is adjusted according to the proportion of the stock dividend. The income statement (or profit and loss) is the first financial statement that most business owners review when they need to calculate retained earnings.

Preparing a Statement of Retained Earnings

Negative retained earnings mean a negative balance of retained earnings as appearing on the balance sheet under stockholder’s equity. A business entity can have a negative retained earnings balance if it has been incurring net losses or distributing more dividends than what is there in the retained earnings account over the years. This is the amount of retained earnings to date, which is accumulated earnings of the company since its inception. Such a balance can be both positive or negative, depending on the net profit or losses made by the company over the years and the amount of dividend paid. The beginning period retained earnings is nothing but the previous year’s retained earnings, as appearing in the previous year’s balance sheet.

We can find the net income for the period at the end of the company’s income statement (consolidated statements of income). Strong financial and accounting acumen is required when assessing the financial potential of a company. Your beginning retained earnings are the retained earnings on the balance sheet at the end of 2020 ($200,000, for example). Well-managed businesses can consistently generate operating income, and the balance is reported below gross profit.

Example of Retained Earnings Calculation

For example, an acceptable range of values will depend not only on the industry and business model but also on the company’s current maturity or status. Newer companies generally don’t pay dividends to the https://www.bookstime.com/statement-of-retained-earnings shareholders as it needs the money for the growth of the company. Already established businesses usually do pay dividends as it will have enough profit for growth projects as well as the shareholders.

- A statement of retained earnings, or a retained earnings statement, is a short but crucial financial statement.

- Further, if the company decides to invest in new assets or purchase additional stock, this can also affect its retained earnings.

- Your beginning retained earnings are the retained earnings on the balance sheet at the end of 2020 ($200,000, for example).

- After subtracting the amount of dividends, you’ll arrive at the ending retained earnings balance for this accounting period.

- For example, if you have a high-interest loan, paying that off could generate the most savings for your business.

- Profits give a lot of room to the business owner(s) or the company management to use the surplus money earned.

- Finding your company’s net income for the period in question is essential to understanding its retained earnings.

Net income that is not included in accumulated retained earnings has been paid out to shareholders as dividends. If a business is not publicly traded, then its dividends would be paid to the owner of the firm. Retained earnings are considered equity and are listed as such in the corresponding section of the balance sheet under shareholders’ equity. However, while they are not assets in themselves, they can certainly be used to purchase or invest in assets of different types.

Statement of Retained Earnings Vocabulary & Definitions

These funds may also be referred to as retained profit, accumulated earnings, or accumulated retained earnings. Often, these retained funds are used to make a payment on any debt obligations or are reinvested into the company to promote growth and development. Generally speaking, a company with a negative retained earnings balance would signal weakness because it indicates that the company has experienced losses in one or more previous years. However, it is more difficult to interpret a company with high retained earnings. For an analyst, the absolute figure of retained earnings during a particular quarter or year may not provide any meaningful insight.

- You also know how to calculate retained earnings using Google Sheets and how a tool like Layer can help you synchronize and manage your financial data.

- These earnings are considered “retained” because they have not been distributed to shareholders as dividends but have instead been kept by the company for future use.

- So, if you want to know your company’s net income, simply subtract its total liabilities from its total assets.

- Thus, it can provide a general indication of how management wants to use excess funds.

- Retained earnings are one of the many financial metrics used to assess a company’s financial health.

- When calculating retained earnings, you’ll need to incorporate all forms of dividends; you’ll see that stock and cash dividends can impact the final number significantly.

- Dividends paid is the amount you spend on your company’s shareholders or owners, if applicable.

Businesses can choose to accumulate earnings for use in the business or pay a portion of earnings as a dividend. As mentioned earlier, retained earnings appear under the shareholder’s equity section on the liability side of the balance sheet. Stock dividends, on the other hand, are the dividends that are paid out as additional shares as fractions per existing shares to the stockholders.

Retained earnings vs. cash flow

Not only is this another financial statement for investors and managers to gain better insight into the company’s performance, but it’s also used to ensure that the company is not violating any laws. Consider instances when companies purchase shares of their own stock into their treasury. Shareholder’s equity section includes common stock, additional paid-in capital, and retained earnings. For instance, a company may declare a stock dividend of 10%, as per which the company would have to issue 0.10 shares for each share held by the existing stockholders. Thus, if you as a shareholder of the company owned 200 shares, you would own 20 additional shares, or a total of 220 (200 + (0.10 x 200)) shares once the company declares the stock dividend.

This is due to the larger amount being redirected toward asset development. For example, a technology-based business may have higher asset development needs than a simple t-shirt manufacturer, as a result of the differences in the emphasis on new product development. For example, during the period from September 2016 through September 2020, Apple Inc.’s (AAPL) stock price rose from around $28 to around $112 per share.