Invoice Guide: Definition, Examples, What to include

However, it’s standard to expect payment within 30 days of receipt of the invoice. Some businesses will opt for shorter or longer payment periods, which are allowed as long as they’re agreed to by both parties beforehand. Invoices serve an important purpose for both the business sending the invoice and the client receiving it. For small businesses, an invoice helps expedite the payment collection process by giving clients a notification of the payment that’s due.

Hand-written invoices

- A purchase order is sent by a customer to a vendor, requesting goods or services.

- Book a demo today to see what running your business is like with Bench.

- Automating your invoice process can streamline your accounting operations and simplify your bookkeeping.

A bill refers to a document of sale wherein customers pay immediately. Customers may also use the term “bill” to describe a request for payment from their vendor. Bills are often less detailed than invoices and require immediate attention. Companies may opt to send a month-end statement as the invoice for all outstanding transactions. If this is the case, the statement must indicate that no subsequent invoices will be sent. Historically, invoices have been recorded on paper, often with multiple copies generated, so the buyer and seller each have a transaction record.

Is an invoice the same as a receipt?

Good invoicing software includes CRM support and a customer portal for customers to track their transactions or make payments online. It is sent to a customer prior to the delivery of goods or services. It describes what the seller will provide, the price that will be charged, and several related items. This document can be used to ensure customer agreement with the amount that will eventually be billed through a regular invoice. It is also used for documentation purposes when shipping goods across international borders. Invoices are an essential tool for business owners when keeping a record of their sales.

How to Send an Invoice

This verifies, in writing, the payment agreement between your business and the client. Good invoices set your payment terms and enable you to get paid faster. While both invoices and receipts are records of transactions, an invoice is a request for payment and indicates the outstanding amount due. In contrast, a receipt is proof of payment, confirming that the owed amount has been paid in full.

A formal invoice sent to a client or customer is an official record of what you provided and what your customer owes. This information is crucial during annual budget reviews and for tax filing purposes. Invoices aren’t just important for requesting payment or receiving payment details, they’re also important to serve as a record of payments and payment requests.

If you are new to this and overwhelmed about handling invoices and payments, don’t worry! Fortunately, creating and managing these critical business documents doesn’t have to be difficult. Create and send an invoice as soon as you complete an order or service. Failing to invoice clients quickly can lead to delayed payments, and timely invoicing can help you improve cash flow. Using metrics like days sales outstanding (DSO) and the accounts receivable turnover ratio can help you keep track of payment speed and your accounts receivable efficiency.

Operating on a subscription pricing model for more than 20 years has given us the opportunity to face and overcome the practical pain points of subscription businesses. An advance payment confirms the client’s commitment and offsets the possible loss to the business if the customer suddenly cancels the project. You can note important account information and mention seasonal promotion details—or you can simply say, “Thank you for your business! Read our article about invoice numbers and learn how you can design a numbering system. Your invoices should always include your name or your company’s name. State your business address and, preferably, your business email and phone number at the top of the invoice.

Generally, the due date is 30 days following the invoice date, but this can vary based on a company’s needs and the agreement with the client or buyer. An invoice is a formal document that itemizes and records a transaction between a vendor and a buyer. Businesses use invoices to ensure they receive timely payments in full.

Records of your invoices can help you develop marketing strategies. You can analyze your invoices to identify peak times when your services are most in demand, the most popular and least popular services you offer, and other trends in your business. Once you identify these trends, you can develop intelligent marketing federal sales tax deduction strategies based on the data to grow your business. Regardless of the method, ensure all essential information, such as the parties involved, description of goods or services, and payment terms, are included. Including discounts, late fees, and partial payment options can further enhance invoice transactions.

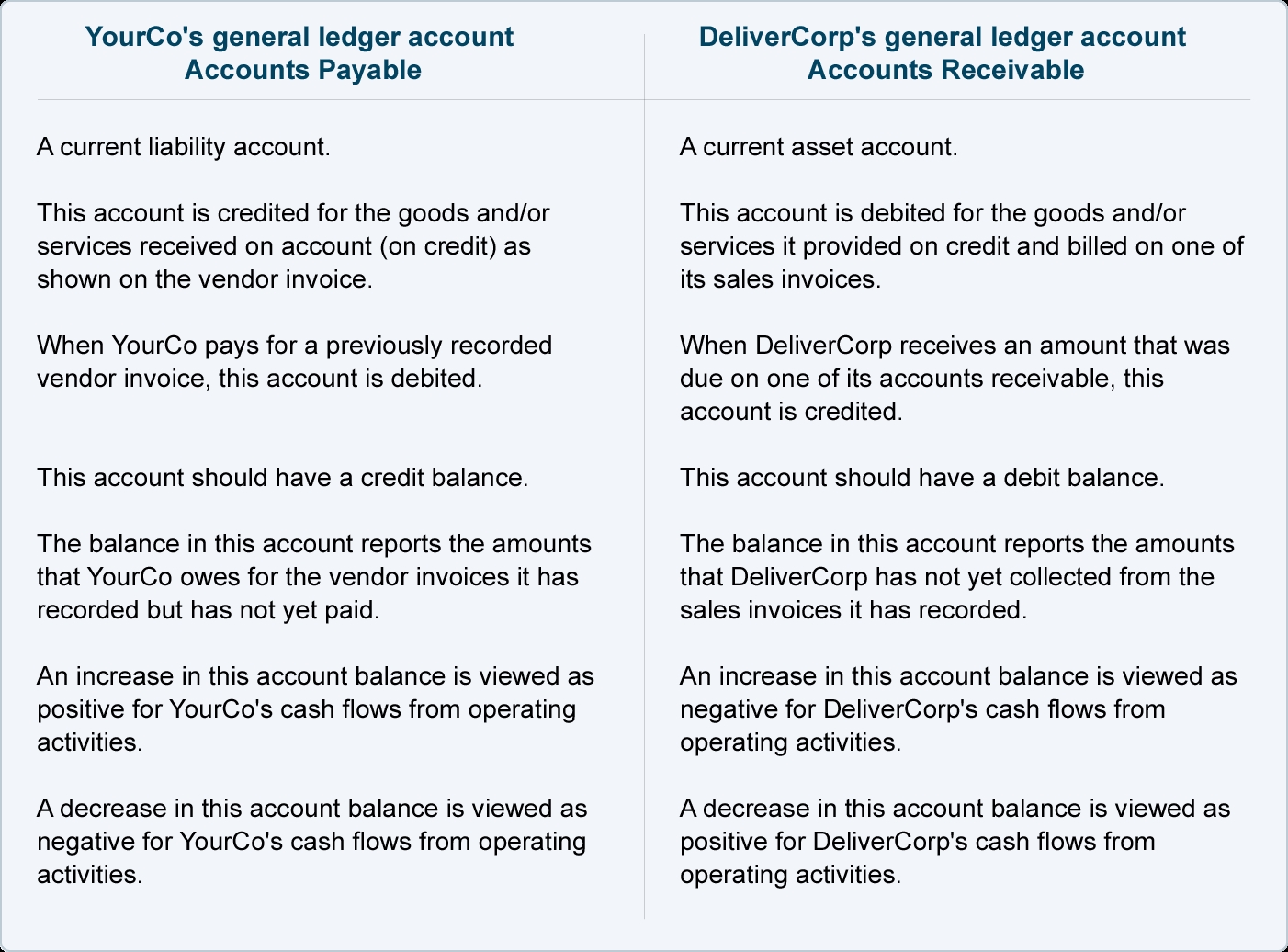

Invoicing plays a crucial role in the legal and financial aspects of any business. It serves as a record of transactions between the buyer and the seller, acting as proof of agreed-upon terms and payment obligations. Proper invoicing practices are essential for managing accounts receivable and maintaining healthy cash flow within businesses. An invoice is a document given to the buyer by the seller to collect payment.

A purchase order is sent by a customer to a vendor, requesting goods or services. As a vendor, you would receive a purchase order, fulfill the order, and then send an invoice to collect payment. An invoice is a document used to state the amount owed by another party and is used to request payment. On the other hand, receipts are used as proof of payment already rendered and are for the payer’s reference and records. It’s good practice to provide a receipt when a client pays their invoice.