Discounted Payback Period Calculator

The calculator’s results help John decide the purchase’s viability and plan accordingly. This scenario highlights the calculator’s versatility in adapting to changing circumstances. But regardless of the application, thinking about when an investment will someday pay off can be very beneficial. Monica Greer holds a PhD in economics, a Master’s in economics, and a Bachelor’s in finance. She is currently a senior quantitative analyst and has published two books on cost modeling.

Video Instructions to Use Payback Period Calculator:

Discounted Cash Flow is a method to evaluate the value of an investment based on future cash flow. It determines the value of an investment based on how much money will generate by this investment. This applies to the investors and entrepreneurs who want to make changes in their businesses.

LogRocket generates product insights that lead to meaningful action

Simply put, it is the length of time an investment reaches a breakeven point. Prior to calculating the payback period of a particular investment, one might consider what their maximum payback period would be to move forward with the investment. This will help give them some parameters to work with when making investment decisions. If the calculated payback period is less than the desired period, this may be a safer investment. The payback period is the duration required to recover an investment’s initial cost through net income or savings. It’s a simple yet effective measure to assess investment risks and liquidity.

What is Discounted cash flow(DCF)?

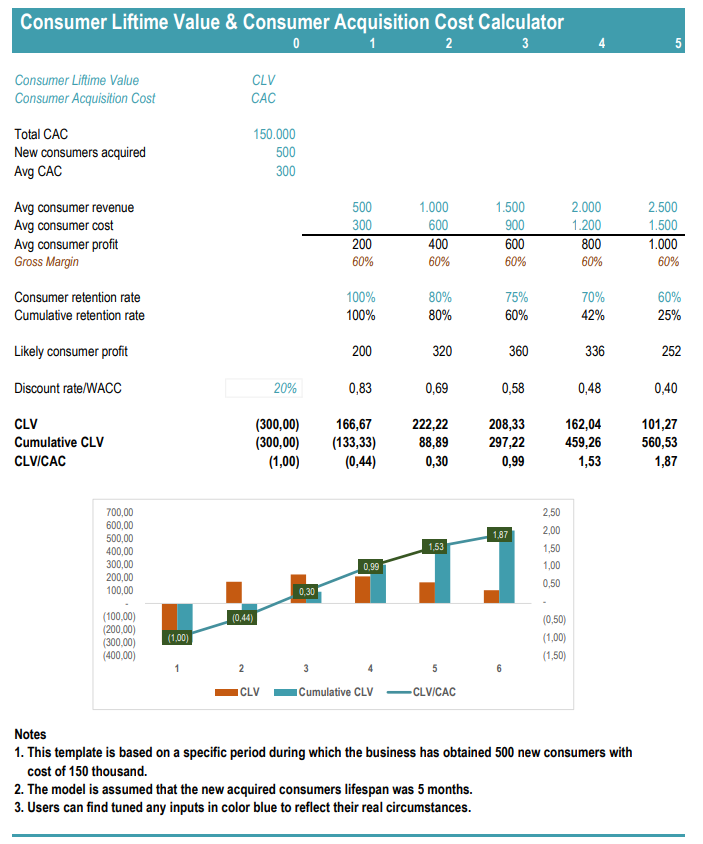

The online discounted payback period calculator performs the calculations based on the initial investment, discount rate, and the number of years. The discounted payback period is often used to better account for some of the shortcomings, such as using the present value of future cash flows. For this reason, the simple payback period may be favorable, while the discounted payback period might indicate an unfavorable investment. The payback period is calculated by dividing the cost of the investment by the annual cash flow until the cumulative cash flow is positive, which is the payback year.

After all, your $100,000 will not be worth the same after ten years; in fact, it will be worth a lot less. Every year, your money will depreciate by a certain percentage, called the discount rate. The payback period can be a valuable tool to help with decision making and prioritization. By considering the payback period alongside feature delivery, you can quickly build a prioritization model that outlines how you came to your revenue projections. Assume Company A invests $1 million in a project that is expected to save the company $250,000 each year.

Finding the payback period corresponds to finding the number of years where the initial negative outlay is matched by positive cash inflows. We should subtract the money inflows from $ initial expenditures for four years before completing the payback period. If you want to pay different payments then our payback calculator assists why real estate investors should consider lease options you to calculate the payback period of irregular cash flow. Calculating the payback period is straightforward since you only need to divide the annual inflow (cash flow) by the initial outflow (investment). In this article, we will explain the difference between the regular payback period and the discounted payback period.

For example, if a company might lose a lease or a contract, the sooner they can recoup any investments they’re making into their business the less risk they have of losing that capital. Let’s assume that you have an investment opportunity that requires you to invest $2,500 that will give you 5 different cash flows. You may want to know how many years it will take you to get yo ur initial investment back. The calculator provides a basic estimation of the payback period based on user inputs. Its accuracy depends on the precision of the input data, particularly cash flow projections. For more detailed analyses, consider using additional financial metrics like NPV or IRR.

- WACC can be used in place of discount rate for either of the calculations.

- Suppose that you are going to invest $100,000 and purchase an apartment.

- In this case, your average monthly revenue for the first six months is $10,000 per month.

- Future cash flows are forecasted and discounted backward in time to arrive at a present value estimate, which is then assessed to see whether the investment is justified.

This period is crucial for investors and businesses as it helps in evaluating the feasibility and profitability of investments. The primary use cases of the payback period include assessing the risk and liquidity of projects. Most capital budgeting formulas, such as net present value (NPV), internal rate of return (IRR), and discounted cash flow, consider the TVM. So if you pay an investor tomorrow, it must include an opportunity cost. Another limitation of the payback period is that it doesn’t take the time value of money (TVM) into account. The time value of money is the idea that cash will be worth more in the future than it is worth today, due to the amount of interest that it can generate.

But there are other situations where applying the payback period is more complex. To do this, you typically forecast how much revenue will be generated on a month-to-month basis over time. For example, let’s say you spent $50,000 to develop a new feature for your product. By launching the new feature, you expect to make $50,000 in the next six months. We’ve all been there — you’re sitting in a meeting and someone asks you how long it’s going to take to make back your investment in a new product feature.