Cost Center vs Profit Center Top 10 Differences You Must Know!

This type of cost center would most likely be overseen by a project management team with a dedicated budget and timeline. A more specific type of impersonal cost center may define a geographical location for a cost center. A company may decide it wants to include or exclude the cost of employees for a certain region.

Profit Centers Generate Revenue – The Importance of Cost Centers and Profit Centers in Achieving Organizational Goals

For this reason, instead of having to juggle multiple competing priorities that detract resources from certain areas, cost centers can focus on what they do best. This means service departments that interact with customers can prioritize the service they deliver and not need to worry about the financial implications of needing to generate a profit. The focus of management with regards to profitcenters, is to maximise revenues generated and limit costs incurred to optimiseoverall profitability of the department. For example, if a cost center is consistently over budget, managers can analyze the costs and make changes to improve efficiency.

Authority of department heads

Transfer Price refers to the price we use to measure the total amount of goods and services that one profit centre supplies to another within the organization. This implies that when the internal transfer of goods and services occurs between different profit centres, its horizontal equity expression should be in terms of money. Hence, the monetary amount of inter-divisional transfers is the transfer price. By identifying and eliminating waste, improving resource utilization, and providing detailed cost information, managers can make better decisions.

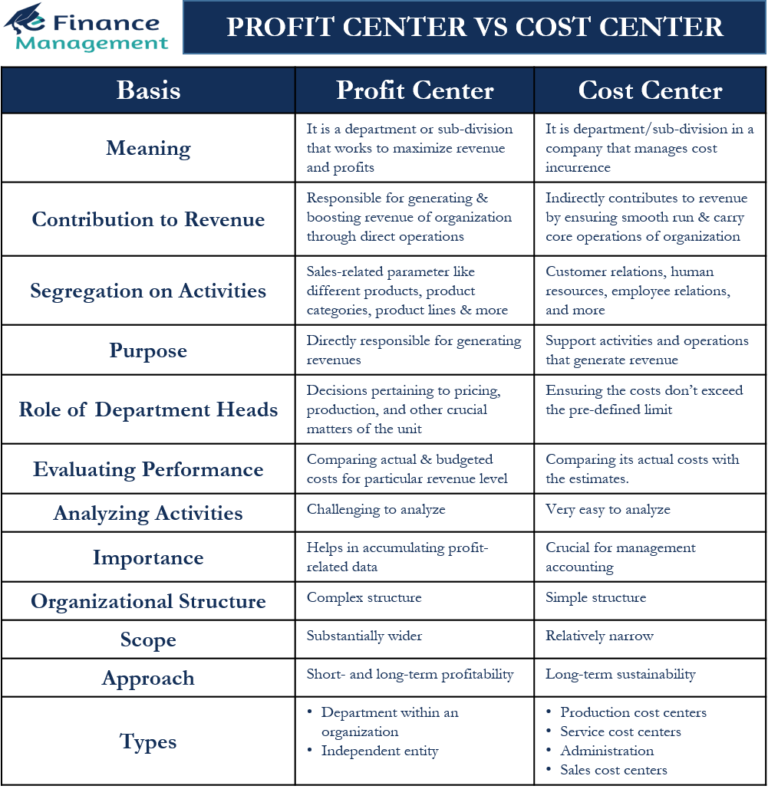

Cost Center vs Profit Center – Key differences

- It can be achieved through process optimization, reducing waste, and eliminating unnecessary expenses.

- Cost centers are typically responsible for managing costs, while profit centers are responsible for generating revenue.

- Cost centers typically have limited decision-making authority, as their primary role is to cost-effectively provide support and services to other parts of the organization.

- Last, cost centers do not inherently provide insights into the profitability or value generation of specific activities.

It requires a clear understanding of the various types of business units within an organization, such as cost and profit centers. The managers or executives in charge of profit centers have decision-making authority related to product pricing and operating expenses. These departments are essential to the overall operations of a company, but they don’t directly generate profit.

Yes, a centralised department can be a profit centre with a limited decision-making authority. Cost centres perform by simply evaluating the actual expenses and then comparing them to the allocated budget. One internal transaction cost in multiple-division companies is how to coordinate the divisions that make internal exchanges so they will achieve what is best for the overall corporation.

Contribution to revenue

Identification of departmentsis essential for multiple reasons including cost allocation and budgeting,staff management, profitability and efficiency analysis etc. They provide valuable insights into the cost structure of an organization, enabling management to identify areas of inefficiency and take appropriate actions. By analyzing cost center data, organizations can make informed decisions regarding resource allocation, process improvements, and cost-saving initiatives.

A cost center manager is only responsible for keeping costs in line with the budget and does not bear any responsibility regarding revenue or investment decisions. Internal management utilizes cost center data to improve operational efficiency and maximize profit. A cost center is a reporting unit of a business that is responsible for costs incurred. Similarly, the accounting, finance, information technology, and human resources departments are all treated as cost centers. As a start-up business grows into a thriving company, it might need to separate into different departments. Some, like sales, are concerned with generating revenue, while others focus on other tasks like accounting and finance.

Cost centers and profit centers are both reasons a business becomes successful. A cost center is a subunit of a company that takes care of the costs of that unit. On the other hand, a profit center is a subunit of a company that is responsible for revenues, profits, and costs. A cost center is a collection of activities that management wishes to track as a group to better understand the expenses necessary to support an organization.

After a few years, Peter Drucker corrected himself by saying that there are no profit centers in business, and that was his biggest mistake. He then said that there are only cost centers in a business and no profit center. If any profit center existed for a business, that would be a customer’s check that hadn’t been bounced. But without the assistance of the cost centers, the profit centers won’t function well.

They can invest capital in outside assets or companies to diversify the company’s risk. They’ll maintain their own financial statements including the income statement, cash flow statement, and balance sheet. Allocation of revenues and costs to profit centersis essential as it helps to identify relative profitability of differentrevenue generating divisions. This helps management in taking various decisionsrelated to income generating operations of the business. An alternative to the cost center approach is to treat a division as if it were like a business that had its own revenues and costs.

Their goal is to maximize revenue while managing costs to ensure sustainable profits and contribute to the company’s long-term success. By contrast, profit centers are any business units that directly generate profit. These include the sales departments and subsidiaries, which are responsible for managing both their own costs and profits. A standalone product line could qualify as a profit center, as could a regional division of the larger company. Profit centers work under the supervision of managers who balance costs and revenues to drive profit. They’re responsible for all actions related to production and the sale of goods.