Chart of Accounts: Complete Guide + Examples

This acts as a company financial health report that is useful not only to business owner, but also investors and shareholders. In the interest of not messing up your books, it’s best to wait until the end of the year to delete old accounts. Your accounting software should come with a standard COA, but it’s up to you and your bookkeeper or accountant to keep it organized.

List: How Do You Create a Chart of Accounts?

Businesses may add, remove, or modify accounts to better track their financial transactions, manage costs, and analyze performance. Customization ensures that a chart of accounts accurately reflects the unique activities and financial structure of a business. Add an account statement column to your COA to record which statement you’ll be using for each account, like cash flow, balance sheet, or income statement.

How a chart of accounts benefits your small business

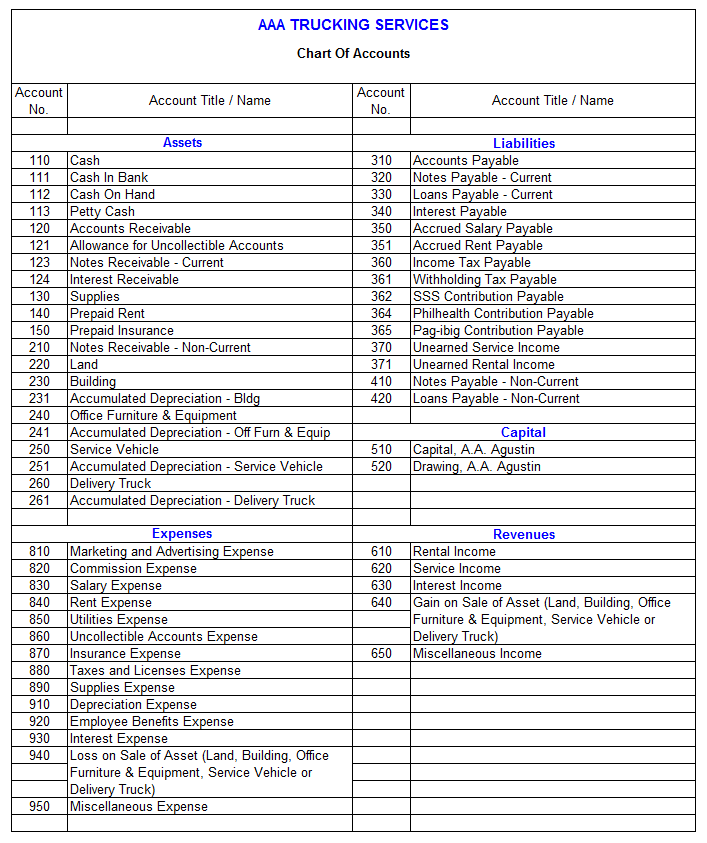

In addition, the operating revenues and operating expenses accounts might be further organized by business function and/or by company divisions. The table below reflects how a COA typically orders these main account types. It also includes account type definitions along with examples of the types of transactions or subaccounts each may include. A COA is a list of the account names a company uses to label transactions and keep tabs on its finances.

Chart of accounts structure

- To better understand how this information is typically presented, you may want to review a sample of financial statement.

- This column shows the financial statement in which the account appears, and for a profit making business is either the balance sheet of the income statement.

- It provides you with a birds eye view of every area of your business that spends or makes money.

- We believe everyone should be able to make financial decisions with confidence.

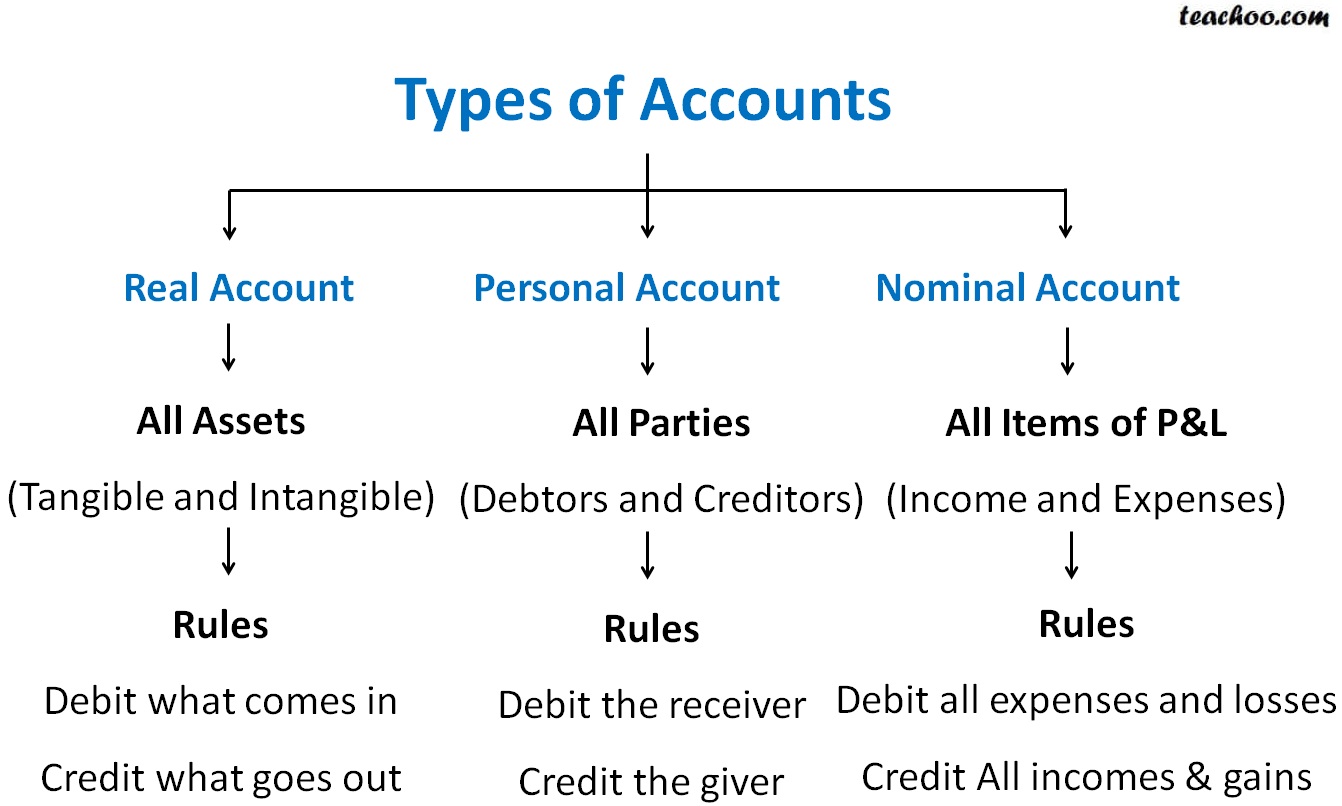

There are five main account type categories that all transactions can fall into on a standard COA. These are asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts. If necessary, you may include additional categories that are relevant to your business. The chart of accounts is the foundation of the businesses accounting system. Using the wrong account code or not having enough codes will limit or produce incorrect financial statements.

Make sure that your line items have titles that make sense to you and your accountant, so use straightforward titles like ‘bank fees’, or ‘bottling equipment’. Expense accounts are all of the money and resources you spend in the process of generating revenues, i.e. utilities, wages and rent. Marshall Hargrave is a financial writer with over 15 years of expertise balanced scorecard spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association. Marshall is a former Securities & Exchange Commission-registered investment adviser and holds a Bachelor’s degree in finance from Appalachian State University.

The more accounts you have, the more difficult it will be consolidate them into financial statements and reports. Also, it’s important to periodically look through the chart and consolidate duplicate accounts. An example of this is if a donation is restricted to specific expenses.

A chart of accounts (COA) is a comprehensive catalog of accounts you can use to categorize those transactions. Ultimately, it helps you make sense of a large pool of data and understand your business’s financial history. It is split between bank, income, direct costs, expenses, assets, liabilities and equity. The software will have a pre-built accounting numbering chart, saving you time and effort.

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Yes, each business should have its own Chart of Accounts that outlines the specific account categories and numbers relevant to their operations. This would include your accounts payable, any taxes you owe the government, or loans you have to repay. But experience has shown that the most common format organizes information by individual account and assigns each account a code and description. What’s important is to use the same format over time for the consistency of period-to-period and year-to-year comparisons.

Learn how to build, read, and use financial statements for your business so you can make more informed decisions. If you don’t leave gaps in between each number, you won’t be able to add new accounts in the right order. For example, assume your cash account is and your accounts receivable account is 1-002, now you want to add a petty cash account. Well, this should be listed between the cash and accounts receivable in the chart, but there isn’t a number in between them. There are many different ways to structure a chart of accounts, but the important thing to remember is that simplicity is key.