Abilene Tax Preparation

Content

When it comes to tax services, we offer extensive year-round services for individuals and small businesses. From helping you manage your income taxes to preparing https://www.bookstime.com/ returns, we help guide you and develop a solid plan. Our tax services focus on you and your goals and help develop a strategy to maximize your earnings.

- Our team offers a wide range of premium financial services for your business.

- Whether you need financial reporting, tax preparation and planning, or payroll processing, we’re able to help individuals and small businesses in Abilene, Texas.

- Good cash management can improve a company’s liquidity, reduce costs, and increase profitability.

- Whether you are a solo entrepreneur needing help with tax returns or a corporation looking for the full accounting package, we promise to provide the highest quality customer service and personal attention you deserve.

- Let us help you avoid these by staying on track and planning appropriately.

Our firm works with his organization and we are listed as his “Endorsed Local Provider” for Tax Services in two large regions of Texas. You can download the complete dataset of Accounting firms used for this analysis from our data store. Here is a random sample of 10 records for you to look at the fields and the data that we provide.

We strive to create a culture of success and profitability for our clients.

No one can predict the future perfectly, but we can all benefit from planning for it. Jaderborg Accounting, Inc. combines expertise and experience with a gained understanding of your business to produce financial projections that can help you manage your business plan and spending. Professional representation can be vital during an audit, and our experience with tax authorities enables us to guide clients in their dealings with federal and state agencies.

- Many firms can operate remotely or virtually, and others that typically operate face-to-face may be changing their procedures to keep up with social distancing guidelines.

- With the help of Wolfe and Company, our CPA accountants will complete some of these tasks for you so you can focus on bigger things.

- Our dedication to high standards, hiring of seasoned tax professionals, and work ethic is the reason our client base returns year after year.

- Accountants may offer a package rate for weekly, monthly or annual services to reward ongoing customers.

- From tax preparation services and payroll services, we will help you keep your business afloat.

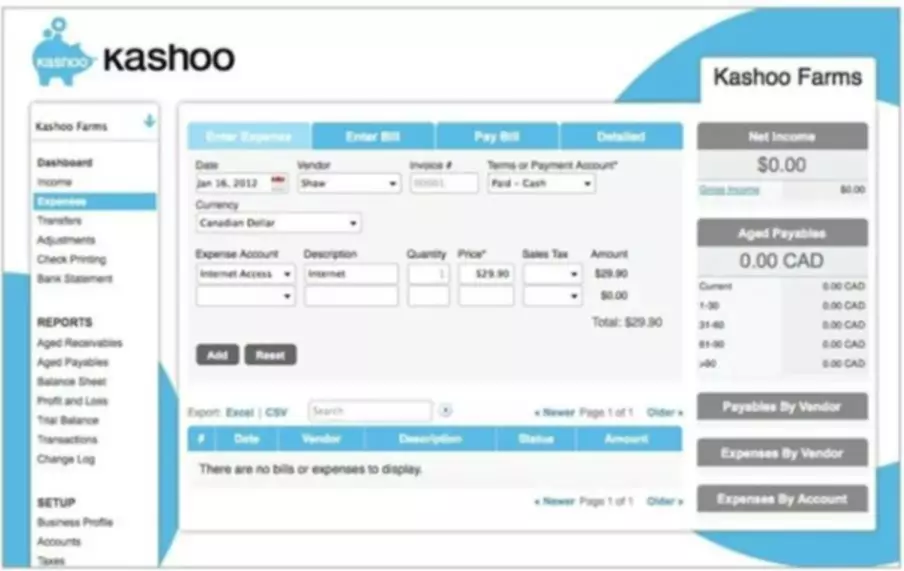

The Accounting Division continues to strive to provide quality financial services to citizens as well as employees. We continue to be impacted by changes required by the Government Accounting Standards Board (GASB). QuickBooks abilene bookkeeping can provide useful and timely information in the form of financial statements, reports and graphs. However, it can only provide this information if you purchase the right product and then install, setup and use it properly.

Accounting

CPAs are also eligible to represent clients before the IRS if audit support is required, while a non-CPA accountant is not. Academic background, years in the field and professional reputation all can affect an accountant’s rates. Accountants are financial professionals who have received an accounting degree from a four-year university or college. By trade, accountants prepare, maintain and examine the financial statements of an individual, business or institution.

- Hourly rates can range as widely as $40 per hour to $300 or more per hour, depending on your geographic location and the accountant.

- From start-ups to established enterprises, businesses rely on accurate and insightful financial information in order to maintain profitability and capitalize on new opportunities.

- When you are in need of a CPA in Abilene, Texas, to help with your tax services, rely on Wolfe and Company, PC.

- Before entrusting someone with your private financial and personal information, do some research on their qualifications.

- Our certified public accountants are knowledgeable, experienced and highly trained in their field.

An accountant prepares reports for tax purposes and can also perform audits of public companies. Our certified professionals can help develop your business strategy and set new goals. From weekly payroll checks to filing annual tax returns, we’ve got you covered. Jennifer Elliott is an accountant who focuses on providing practical financial solutions to individuals and businesses alike. She has advised thousands of individuals on their taxes to set them up for long-term financial success and with over 12 years of experience in the field, she is an expert in creating financial solutions and strategies. As the saying goes, “Money can’t buy you happiness.” And if your earnings are not managed well, money can be the source of a lot of stress.