Accrued Expenses What’re They, Examples, How To Record

INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. GAAP recognizes the double-entry system, and thus, several companies follow it around the globe. Therefore, using such a system make the company compliant with international standards. Accrued expenses don’t represent the exact amount due in the future, but only a close estimate. Jump forward to the end of March, the bill finally arrives, and it accounts for $160.

Following the accrual method of accounting, expenses are recognized when they are incurred, not necessarily when they are paid. Prepaid expenses are an asset on the balance sheet, as the goods or services will be received in the future. Like accrued expenses, prepaid expenses are also recorded in the reporting period when they are incurred under the accrual accounting method.

Typical examples of prepaid expenses include prepaid insurance premiums and rent. Accrued expenses are recognized in the period of incurrence for which the invoice has not been received yet. When an accrual expense is recognized, it is recognized as an expense in the Income statement, and simultaneously being unpaid, it gets recorded as a liability in the balance sheet. Therefore, whenever an expense is accrued it is forms part of in the current liability under the balance sheet.

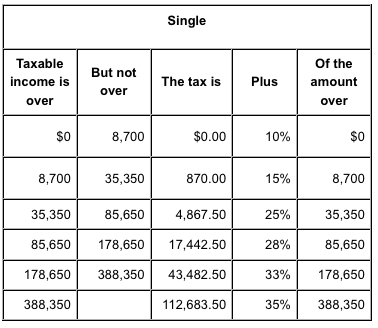

For instance, at the end of November 30, the company would have owed employee wages for ten days from 21st to the 20th. As a result, the business needs to report accrued expenses for salaries owed. Tax payment deadlines do not coincide with the end of the reporting period, but companies still have to record tax expenses for the period. For instance, the income tax payment deadline for a calendar year could be on July 31. This post will focus on incurred and accrued expenses to better understand the accounting process. Refers to the practice of recording financial transactions as they happen – regardless of any cash exchange.

Another familiar scenario where companies record accrued expense is when pay periods do not coincide with the accounting period. For instance, the cut-off for calculating monthly payroll is on the 5th and 20th of the month. Money owed by a business in the current accounting period is to be accrued and should be added to the expenses in the profit and loss account.

- He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

- Accounting PeriodAccounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared.

- It is the result of accrual method of accounting under which expenses are recorded in the accounting period in which they are incurred.

- Learn leadership from scratch including different leadership styles, skills you should adapt, and examples of great leaders.

- This can be financially devastating, affecting the company’s ability to continue operations in a profitable way.

While incurred and accrued mean different things, some may confuse one for the other. Accruals are the expenses and revenues that have beenincurred but not recorded in the books of accounts. Let’s take a look at the adjusting journal entries to record an accrued expense. Accrued taxes are the amount of taxes assessed to a company that are still pending payment. Accrued taxes are notated in the general ledger and listed as a liability for the company on the balance sheet.

Clubs receive immediate cash payment for sales, while inventories, accrued expenses, and other current liabilities normally carry longer payment terms. The accrual method of accounting is considered a more laborious form of accounting because it involves a dual entry. With an accrual basis, you must reconcile the entry when the account is paid. However, accrual-basis accounting is considered a more accurate form of business accounting, telling a more complete picture of financial health. Additionally, utilities or unreimbursed employee travel are other accrued expenses examples. Also, we may note accrued taxes or accrued compensation in the general ledger.

This includes things like employee wages, rent, and interest payments on debt owed to banks. We’ve highlighted some of the obvious differences between accrued expenses and accounts payable above. But the following are some of the main factors that set these two types of costs apart. This means that companies are able to pay their suppliers at a later date.

Certification Courses

Otherwise, the company could over-extend itself, because it doesn’t know it has committed more money than it has available. This can be financially devastating, affecting the company’s ability to continue operations in a profitable way. Accounting PeriodAccounting Period refers to the period in which accrued expenses meaning all financial transactions are recorded and financial statements are prepared. One of the many advantages of recording accrued expenses is to identify the true profit of the company. If a company does not add the expense that it needs to pay somewhere in the future, the profit might inflate.

The company then receives its bill for the utility consumption on March 05 and makes the payment on March 25. For example, suppose we’re accounting for an accrued rental expense of $10,000. As a result, the accrued expense balance increases from the unpaid employee wages caused by the timing mismatch. For example, let’s say that a company’s employees are paid bi-weekly and the starting date is near the end of the month in December. Jumbo Inc. borrowers a $5,00,000 loan on 1 March for business purpose from the bank. The loan agreement requires Jumbo Inc.to to repay the $5,00,000 loan on 31 July along with a $5,000 interest for the five months from March to July.

Is an accrued expense a debit or credit?

Therefore, the accrual method of accounting is more commonly used, especially by public companies. International Financial Reporting Standards and Generally Accepted Accounting Principles both require companies to implement the accrual method. With that said, the standard modeling convention for modeling the current liability is as a percentage of operating expenses — i.e. the growth is tied to the growth in OpEx. Emerging technologies will continue to improve and upgrade, but they will never completely replace the human component.

Accrued expenses are recognized on the books when they are incurred, not when they are paid. Like the example above, operating expenses like supplies would be on purchase. However, companies also incur an expense due to the passage of time or consumption.

Also, from an investor’s perspective, accrued expense helps ascertain an accurate picture of the company’s profit. Accounting SystemAccounting systems are used by organizations to record financial information such as income, expenses, and other accounting activities. They serve as a key tool for monitoring and tracking the company’s performance and ensuring the smooth operation of the firm. Accrued expense entry is based on the double-entry system, which means that debit in one account and credit in the other account. An account manager or anyone looking at the books can see the accounts that such an expense affects.

How Are Accrued Expenses Accounted for?

This is very useful for interested third parties, such as creditors, investors, suppliers, and anyone else who needs to assess the financial situation of the business. Since the business uses the accrual basis of accounting, expenses are recorded when they happen. That means that the firm needs to accrue the utility expense for the end of January.

The meaning of accrued expenses signifies expenses incurred but not paid by the business during the accounting period. These expenses are reflected on the business’s balance sheet under short-term liabilities and should be monitored closely by those tracking the business. Its performance and changes in such expenses should be duly accounted for in the profit reported by the business. Accrued expenses are expenses that have already been incurred, but for which no billing documentation has yet been received.

Companies that fail to pay these expenses run the risk of going into default, which is the failure to repay a debt. Accrued expenses are adjusted and recorded at the end of an accounting period while accounts payable appear on the balance sheet when goods and services are purchased. When you’re dealing with current liabilities, you’re managing obligations typically due within one year. Current liabilities are important because they represent the short-term obligations of a company. You might have a few different types of current liabilities, which include accounts payable, taxes payable, and short-term debt. Accrued expenses are recorded under the accrual basis of accounting, therefore the transactions are recorded immediately at the time of happening.

When Do Companies Incur an Expense?

If the company only looks at the $3,000, it will have an inflated sense of profit for the month. With the accrual method, the profit will be $1,800 because we subtract the accrued expense from the revenues. GAAP only allows the accrual basis of accounting as a method of recognizing expenses and revenue. It’s only relevant for public companies that release their financial statements.

Until 31 July the company is not going to have the invoice which could be processed and is not going to pay the interest of $5,000 until 31 July. To accrue means to accumulate over time, and is most commonly used when referring to the interest, income, or expenses of an individual or business. When a company accrues expenses, its portion of unpaid bills also accumulates.

Accrual accounting is where a business records revenue or expenses when a transaction occurs using the double-entry accounting method. For example, a company wants to accrue a $10,000 utility invoice to have the expense hit in June. The company’s June journal entry will be a debit to Utility Expense and a credit to Accrued Payables. Then, the company theoretically pays the invoice in July, the entry will offset the two entries to Utility Expense in July. For companies that are responsible for external reporting, accrued expenses play a big part in wrapping up month-end, quarter-end, or fiscal year-end processes.

Automate your accounts payable with a recurring bill feature you can set up and switch on with just one click, by using the Deskera billing software. But even if you’re a small business complying with the GAAP, it can grant you the benefits of comparability and transparency which investors and other interested third parties appreciate. It’s more likely that a bank will grant you a loan, and a supplier will sell you merchandise on credit if your accounting accurately portrays the business’s financial status.

The most common accrued expenses include interest, payroll, utilities, employee benefits, and unbilled goods and services. On the other hand, accrued expenses are an estimated sum of the company’s liabilities; these figures are eventually adjusted to reflect exactly what is owed after bills or invoices are received. Although the cash basis might seem a more straightforward way of doing accounting, the accrual basis has proven to be the better measure for a company’s profitability. Well, an accrued expense is typically just an estimate and doesn’t represent the exact payment due. So, if electricity normally costs the business $50 per month, that’s the amount that would be accrued at the end of January through a journal entry.